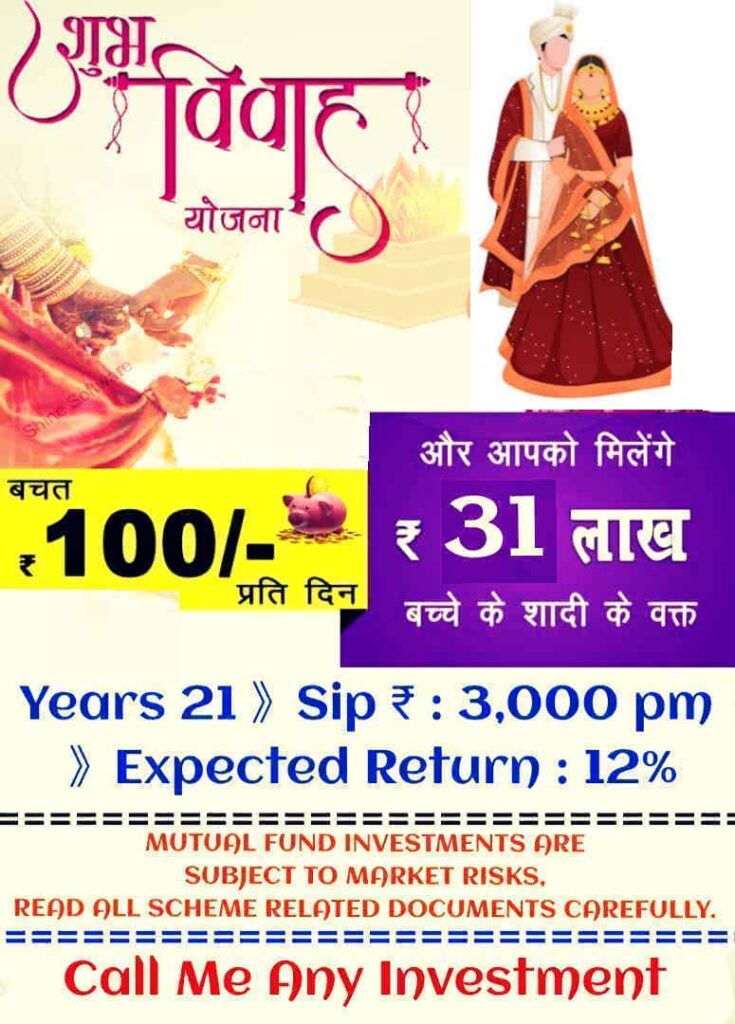

Planning for children’s marriage starts when the children are young. You must save and invest as early as possible to give the money the time to grow into a large corpus. You must choose an investment that offers return above inflation over the long term.

Invest in equity or fixed income securities as per your risk profile to accumulate the corpus at the time of the financial goal. You get the benefit of the power of compounding or return on returns, where a small investment grows into a large sum of money over some time.

You must plan the investment depending on the time horizon and risk tolerance. If you are a conservative investor, you can invest in fixed income securities that offer return above inflation over some time. The aggressive investor can choose equity investments that provide higher returns for a higher risk. You may invest in equity investments with a time horizon of at least five to seven years, to achieve the financial goal of children’s marriage.